Bismarck, N.D. – According to the state officials, this package will reportedly provide a combined $515 million in savings for payers of state individual income tax and local property tax over the next two years.

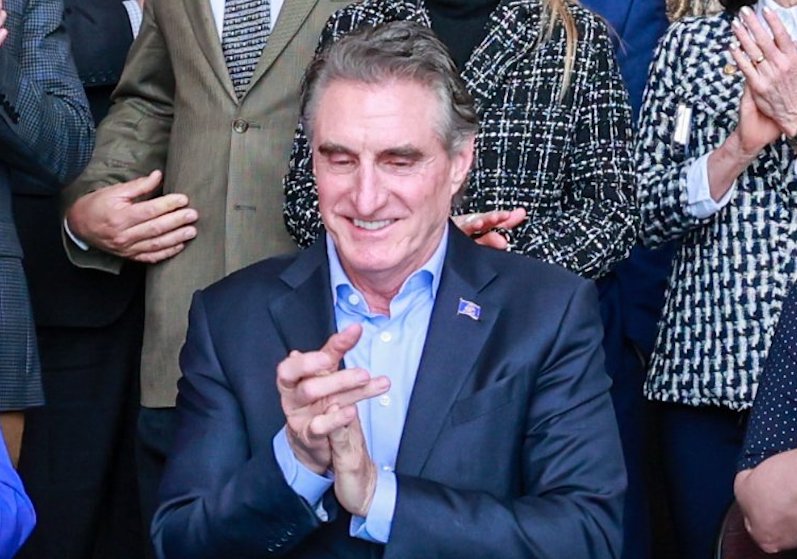

State officials also announced that Governor Burgum signed House Bill 1158 with Rep. Craig Headland, the bill’s prime sponsor, House Majority Leader Mike Lefor, Senate Majority Leader David Hogue, bill sponsors, Kroshus and other bill supporters during a ceremony at the Capitol.

House Bill 1158 will reportedly provide $358 million in individual income tax relief by zeroing out the state’s bottom tax bracket and combining the top four brackets into two brackets with reduced tax rates.

The two middle income brackets will be taxed at 1.95%, down from 2.04% or 2.27%, and the top two brackets will be taxed at 2.5%, down from 2.64% or 2.9%.

The changes will result in an estimated $104 million in savings for the zeroed-out bottom bracket, $178 million in savings for the combined middle-income brackets and $76 million in savings for the combined top brackets